Your credit score plays a vital part in your money related wellbeing, influencing everything from advance endorsements to intrigued rates. Observing your credit score routinely can assist you remain on beat of your funds and make educated choices. If you’re wondering how to check your gomyfinance.com credit score for free, this guide will walk you through the process step by step.

Why Checking Your Credit Score is Important?

Before diving into the steps, it’s essential to understand why monitoring your credit score is crucial:

- Financial Awareness: A good credit score opens doors to better financial opportunities, such as lower interest rates and higher loan approvals.

- Error Detection: Sometimes, incorrect information can lower your score. Regularly checking ensures that your credit report is accurate.

- Fraud Prevention: Identity theft is a rising concern in 2025. Monitoring your credit helps detect unauthorized activities.

- Loan & Credit Card Approvals: Lenders review your credit score before approving loans. Knowing your score helps you apply for the right financial products.

How to Check Your gomyfinance.com Credit Score for Free

Checking your gomyfinance.com credit score is a straightforward process. Follow these steps to access your score without any cost:

Step 1: Visit gomyfinance.com

Start by opening your preferred web browser and going to the official gomyfinance.com website. Make sure you are on the official site to avoid phishing or scam websites.

Step 2: Sign Up or Log In

- If you’re a new user, create an account by providing your email address, name, and phone number.

- If you as of now have an account, basically log in utilizing your enlisted credentials.

Step 3: Provide Basic Information

To retrieve your credit score, you may need to provide some basic personal details such as:

- Full Name

- Date of Birth

- Social Security Number (SSN) or equivalent identification

- Address and contact details

Step 4: Verify Your Identity

For security reasons, gomyfinance.com may require additional identity verification. This may include:

- Answering security questions based on your credit history.

- Entering a confirmation code sent to your enrolled mail or phone number.

Step 5: Access Your Free Credit Score

Once verification is complete, your credit score will be displayed on your dashboard. You can view it instantly and analyze the details provided.

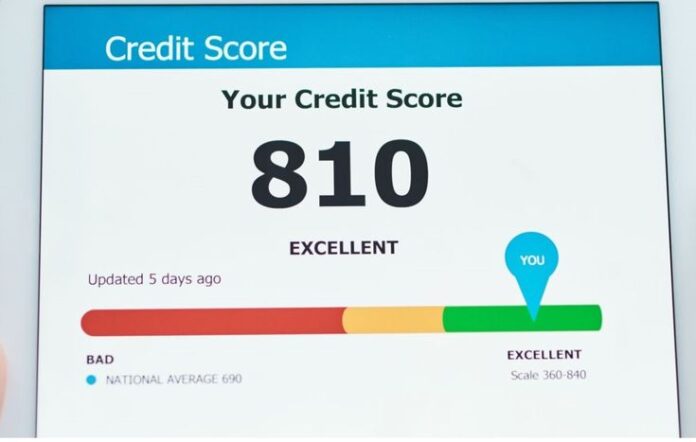

Understanding Your gomyfinance.com Credit Score

Your credit score will fall within a specific range. Here’s what each range typically means:

- 800 – 850 (Excellent): You have strong creditworthiness and can access premium financial products.

- 740 – 799 (Very Good): You qualify for great interest rates and loan approvals.

- 670 – 739 (Good): You have a decent credit history but may face slightly higher interest rates.

- 580 – 669 (Fair): You may struggle to get favorable loan terms.

- 300 – 579 (Poor): You might need to improve your credit before applying for loans or credit cards.

Tips to Improve Your gomyfinance.com Credit Score

If your credit score is lower than anticipated, here are a few methodologies to progress it:

- Pay Bills on Time: Late installments can altogether affect your score.

- Keep Credit Utilization Moo: Point to utilize less than 30% of your accessible credit.

- Limit New Credit Inquiries: Too many applications in a short time can lower your score.

- Check for Blunders: Debate any mistakes in your credit report instantly.

- Maintain Old Accounts: Older credit accounts help build a strong credit history.

How Often Should You Check Your Credit Score?

It’s recommended to check your credit score at least once a month to track any changes. Regular monitoring helps you stay informed about your financial health and take corrective actions if needed.

Conclusion

Checking your gomyfinance.com credit score for free is a simple process that allows you to stay updated on your financial standing. With regular monitoring, you can ensure your credit score remains strong, helping you secure better loan terms, lower interest rates, and overall financial stability.

Begin checking your credit score nowadays and take control of your money related future!